The 10-Second Trick For Home Owners Insurance In Toccoa Ga

Wiki Article

The Main Principles Of Home Owners Insurance In Toccoa Ga

Table of ContentsFascination About Insurance In Toccoa GaNot known Details About Home Owners Insurance In Toccoa Ga Health Insurance In Toccoa Ga Fundamentals ExplainedFinal Expense In Toccoa Ga - QuestionsThe 4-Minute Rule for Life Insurance In Toccoa GaThe Definitive Guide for Commercial Insurance In Toccoa Ga

This might indicate scheduling an one-time session with a counselor to optimize your finances or it could suggest having a qualified financial investment advisor on retainer to manage your assets. Payment frameworks vary relying on client requirements and the services offered by the economic consultant. A monetary advisor might work for a firm and as a result make a salary, or they might make a hourly rate individually.Below are five actions to aid you select a financial expert for you. Handling your wealth is hard. Zoe Financial makes it very easy. Discover and hire fiduciaries, economic consultants, and financial organizers that will work with you to accomplish your wide range goals. Paid non-client promo, Nerd, Wallet does not invest its cash with this company, but they are our reference partner so we get paid just if you click with and take a certifying action (such as open an account with or provide your call info to the service provider).

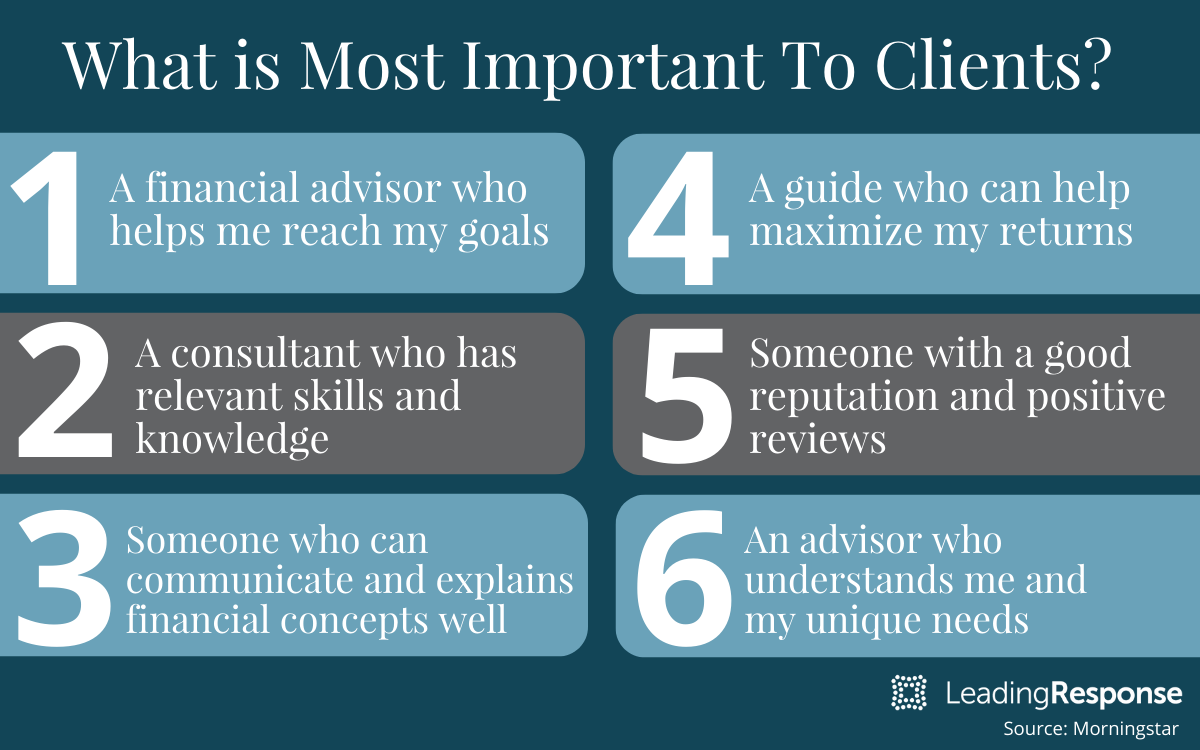

Our opinions are our own. http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1891. Below is a and here's exactly how we generate income. Prior to you begin looking for the right consultant, assess what you're intending to obtain out of that relationship. Financial advisors offer a wide variety of solutions, so it's a good idea to know what you need aid with before you begin your search.

The Ultimate Guide To Affordable Care Act Aca In Toccoa Ga

Recognize why you're looking for monetary aid by asking the following concerns: Do you need help with a spending plan? Do you desire help investing? Would you like to produce an economic strategy? Do you have savings goals you need help reaching? Do you need to get your estate plan in order or create a depend on? Are you curious about all natural financial administration? Your solution to these inquiries will certainly aid you locate the best sort of economic expert for you., or CFP, designation have a fiduciary duty to their customers as part of their certification (https://www.webtoolhub.com/profile.aspx?user=42362864).

Nerd out on spending news, Register for our regular monthly investing e-newsletter for our nerdy take on the stock exchange. Financial consultants have an online reputation for being expensive, but there is a choice for every single budget plan. It is essential to recognize exactly how much an economic advisor expenses prior to you commit to services.

What Does Automobile Insurance In Toccoa Ga Mean?

Exactly how much you need to invest in a financial expert depends upon your budget, assets and the level of financial advice you require. If you have a little portfolio, an in-person expert could be excessive you will conserve money and obtain the support you need from a robo-advisor. If you have a difficult financial scenario, a robo-advisor may not provide what you need.25% of your account balance per year, standard in-person experts usually set you back around 1% and online financial preparation solutions tend to drop someplace in between. Who can be a monetary consultant?

Why is "advisor" in some cases meant "advisor"? Some companies like the Structure for Financial Preparation use cost-free aid to individuals in need, including veterans and cancer cells people. And while you should not think every little thing you check out on the web, there are heaps of trustworthy resources for economic details online, consisting of federal government resources like Financier.

If you are attempting to select an economic expert, understand that anybody can legally use that term. Constantly request (and verify) an advisor's details qualifications. Anybody that offers which most monetary advisors do have to be signed up as an investment expert with the SEC or the state if they have a specific amount of assets under monitoring.

Lead ETF Shares are not redeemable straight with the providing fund apart from in large gatherings worth millions of bucks. ETFs go through market volatility. When buying or marketing an ETF, you will pay or obtain the present market price, which might be basically than internet possession value.

The Basic Principles Of Commercial Insurance In Toccoa Ga

The majority of economic experts function routine full time hours during the work week. Many experts are used by firms, yet about 19% of monetary consultants are freelance, according to data from the Bureau of Labor Statistics. In regards to credentials, monetary consultants usually have at least a bachelor's level in an associated subject like company, money or mathematics.Medicare Medicaid in Toccoa GA

However, there are some vital differences in between a financial expert and an accountant that you need to recognize. Accountants are extra focused on tax obligation planning and preparation, while economic consultants take an all natural check out a customer's financial circumstance and aid them plan for long-lasting economic objectives such as retirement - Home Owners Insurance in Toccoa, GA. Simply put, accounting professionals manage the past and existing of a customer's finances, and monetary consultants are concentrated on the customer's economic future

8 Easy Facts About Annuities In Toccoa Ga Shown

Accounting professionals tend to be worked with on a short-term basis and can be assumed of as specialists, whereas financial experts are most likely to establish a lasting expert partnership with their clients. Accountants and monetary experts differ in their method to economic topics. Accountants have a tendency to specialize in a particular area, while monetary consultants are frequently generalists when it pertains to their economic competence.Report this wiki page